In an era where digital banking dominates the financial landscape, choosing the best online bank for your needs has never been more crucial. With the rise of online banks offering convenience, lower fees, and competitive interest rates, it’s essential to navigate through various options carefully. This guide will help you understand the key factors to consider when selecting an online bank that aligns with your financial goals.

Why Choose an Online Bank?

Online banks are reshaping the way people manage their finances. Unlike traditional brick-and-mortar banks, online banks operate entirely over the internet, which often allows them to offer lower fees and higher interest rates on savings accounts. Here are some compelling reasons to consider an online bank:

- Lower Fees: Many online banks have minimal overhead costs, allowing them to eliminate common charges like monthly maintenance fees.

- Higher Interest Rates: Online banks often provide higher annual percentage yields (APYs) for savings accounts and certificates of deposit (CDs).

- Convenience: Access your account 24/7 via mobile apps and websites.

- Innovative Features: Many online banks offer advanced features like budgeting tools, early paycheck access, and instant fund transfers.

Key Factors to Consider When Choosing an Online Bank

Selecting the right online bank requires a thorough evaluation of several factors. Here are the most important ones to keep in mind:

1. Security Features

Your online bank should prioritize the safety of your funds and personal information. Look for banks that offer:

- Two-Factor Authentication (2FA): Adds an extra layer of security to your account login process.

- Encryption Technology: Ensures that your data is protected during transactions.

- FDIC Insurance: Verify that the bank is insured by the Federal Deposit Insurance Corporation, covering deposits up to $250,000 per account.

2. Account Options

Consider the types of accounts offered by the online bank. Popular options include:

- Checking Accounts: Ensure they have no hidden fees and provide features like overdraft protection.

- Savings Accounts: Look for competitive APYs and minimal deposit requirements.

- Specialized Accounts: Some banks offer retirement accounts (IRAs) or money market accounts.

3. Fee Structure

Online banks generally have fewer fees than traditional banks, but it’s essential to review their fee policies. Common fees to watch out for include:

- ATM fees

- Overdraft fees

- Wire transfer fees

- International transaction fees

Opt for an online bank that minimizes or eliminates these charges.

4. Interest Rates and Rewards

High-yield savings accounts are a hallmark of online banks. Compare interest rates among different banks to maximize your earnings. Additionally, some banks offer cash-back rewards or bonus interest rates for maintaining a minimum balance.

5. Mobile App and Online Interface

A user-friendly mobile app and website are critical for managing your accounts. Test out the app’s features and read reviews to ensure it meets your needs. Features to look for include:

- Easy navigation

- Bill payment and money transfer options

- Budgeting and spending analysis tools

6. Customer Support

Even with the best technology, excellent customer support is invaluable. Look for banks that provide:

- 24/7 chat or phone support

- Comprehensive FAQs and resources

- Responsive social media channels

7. ATM Access and Deposit Options

If you need to deposit cash or withdraw funds frequently, ensure the online bank has a robust ATM network. Some online banks even reimburse out-of-network ATM fees.

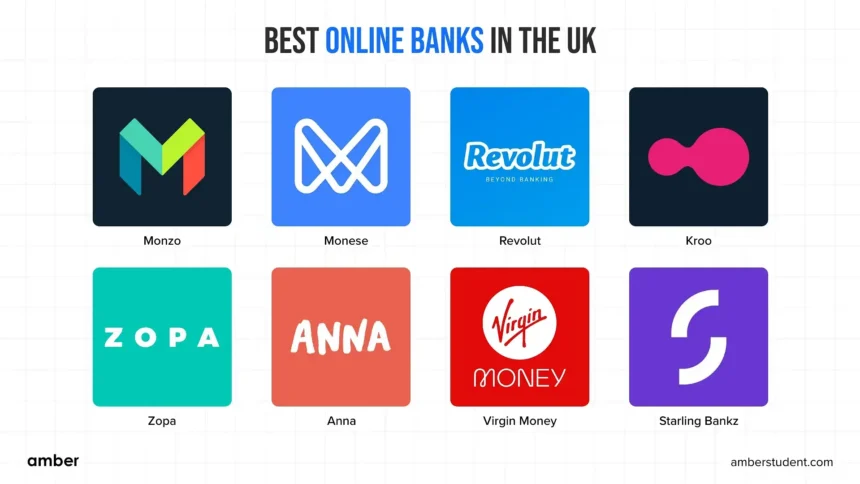

Popular Online Banks in 2024

Here are some of the top online banks to consider in 2024, based on their features and customer reviews:

- Ally Bank

- High-yield savings accounts

- No monthly maintenance fees

- Robust mobile app

- Discover Bank

- Competitive APYs

- Cash-back checking accounts

- Excellent customer support

- Chime

- Early paycheck access

- No overdraft fees

- Fee-free ATMs

- Capital One 360

- No minimum balance requirements

- High-rated mobile app

- Extensive ATM network

- SoFi

- Comprehensive financial tools

- High interest rates

- Investment and loan options

How to Open an Online Bank Account

Opening an account with an online bank is straightforward and typically faster than with traditional banks. Follow these steps:

- Research and Compare Banks: Use the factors mentioned above to narrow down your options.

- Prepare Your Documents: You’ll need identification (e.g., driver’s license or passport), Social Security number, and proof of address.

- Complete the Online Application: Fill out the bank’s online form with your details.

- Fund Your Account: Deposit the required minimum balance, if applicable.

- Download the Mobile App: Start managing your account through the bank’s app or website.

Pros and Cons of Online Banking

Pros:

- Lower costs

- Higher interest rates

- 24/7 access

- Eco-friendly (no paper statements)

Cons:

No physical branches

Limited cash deposit options

Potential for technical issues

Choosing the best online bank requires careful consideration of your financial needs and preferences. By focusing on security, fees, interest rates, and customer service, you can find a bank that offers the perfect blend of convenience and value.

Whether you’re looking to save more, simplify your financial management, or access innovative tools, the right online bank can transform the way you handle money. Start your journey today and make the switch to smarter banking.